7 Simple Techniques For Frost Pllc

Table of ContentsThe Facts About Frost Pllc UncoveredThe smart Trick of Frost Pllc That Nobody is DiscussingSome Known Facts About Frost Pllc.Some Known Factual Statements About Frost Pllc Not known Details About Frost Pllc All about Frost Pllc5 Simple Techniques For Frost Pllc

And aligning your group towards overall goals should not be undervalued. Have regular meetings with team to track and report your development. Going through the movements of adjustment is excellent, but without a technique of dimension, monitoring your development and coverage, it's challenging to recognize what's working and what isn't. You are the leader.These certifications will certainly offer you the knowledge you need to run your company efficiently and assure prospective customers that you recognize what you're doing. Qualifications are not the same as experience. Having at the very least a couple of years of book-keeping job under your belt is useful prior to you start out on your very own.

The precise amount you will need to get your company up and running depends significantly on the scale of the procedure you're intending. Establishing up a book-keeping firm for relatively little initial outlay is feasible, specifically when you utilize software application membership services rather than purchasing software outright.

3 Simple Techniques For Frost Pllc

One of the initial things that potential clients will certainly desire to be assured of is that you are utilizing top-of-the-range, protected, innovative, and credible accounting technology. An expense management as welll will let you track billable expenditures, configure allocate each project and track spend versus them, and specify task guidelines and plans to ensure compliance.

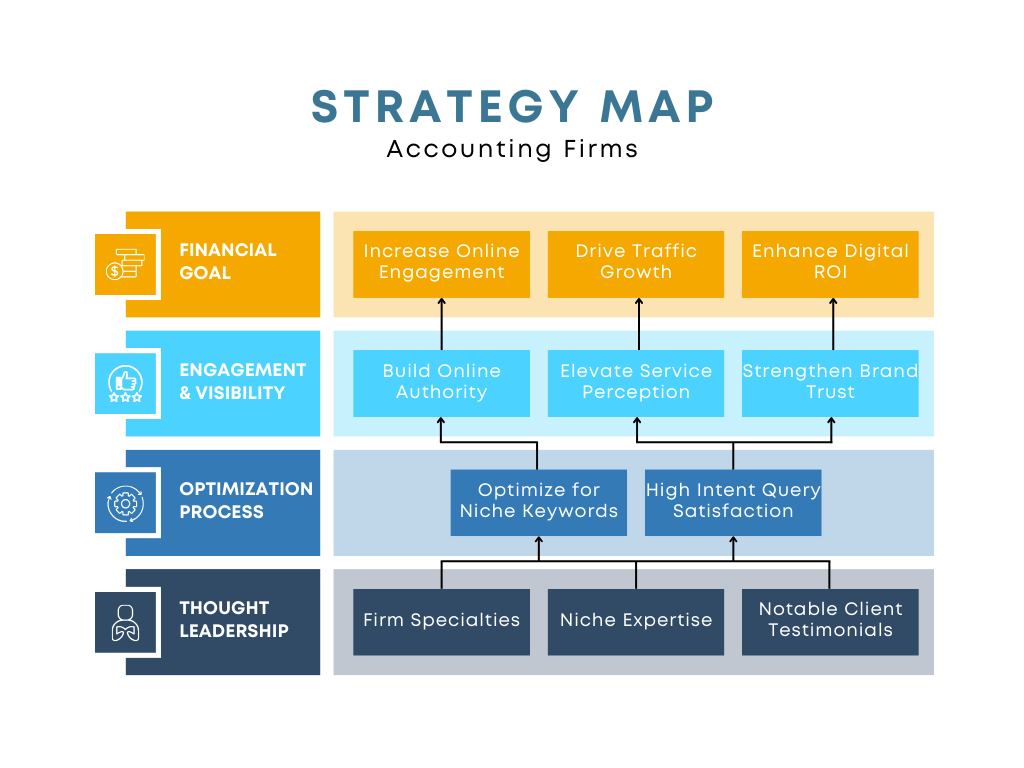

Through a good marketing and branding strategy, you can: Build understanding concerning your audit company. Keep and boost partnerships with current clients. It can be tempting to market on the go, with the periodic press launch or social media blog post as the possibility arises.

Via method, you can grow your organization and track record a lot faster than would certainly otherwise hold true, with much less danger than would otherwise be the situation. The price of starting a bookkeeping firm relies on extremely variable aspects, including where you remain in the world, dominating advertising conditions, and the services you plan to provide.

Not known Details About Frost Pllc

As your service expands, added insurance like Employment Practices Obligation Insurance Coverage (EPLI) and employees' settlement insurance policy will add to your costs. The price of renting workplace room varies considerably relying on area and size. If you choose to rent, you'll need to allocate energies, cleansing solutions, car park, and workplace style.

Reliable branding and advertising and marketing are important to bring in customers. Prices can range from easy pay-per-click (PPC) marketing to more complex branding strategies involving personalized logo designs, web sites, and marketing materials. Considering all these factors, the price of beginning an accountancy firm could vary from as low as $2,000 to over $200,000, relying on the range and complexity of your procedure.

Begin with fundamental bookkeeping, tax obligation preparation, or pay-roll solutions. The audit field frequently develops, and staying current with the newest advancements is important.

Word of mouth is the most typical way for book-keeping companies to acquire brand-new customers, as trust and track record play such an important part in book-keeping. There are methods to guarantee that word gets out regarding you and your company - Frost PLLC. : in your community through professional speaking interactions, providing sponsorships, believed management projects, and usually obtaining your face out there.

Frost Pllc for Dummies

Pals, household, and customers are all fantastic places to begin when gathering brand-new customers. Many accounting companies look for a combination of technical abilities, experience, and soft skills.

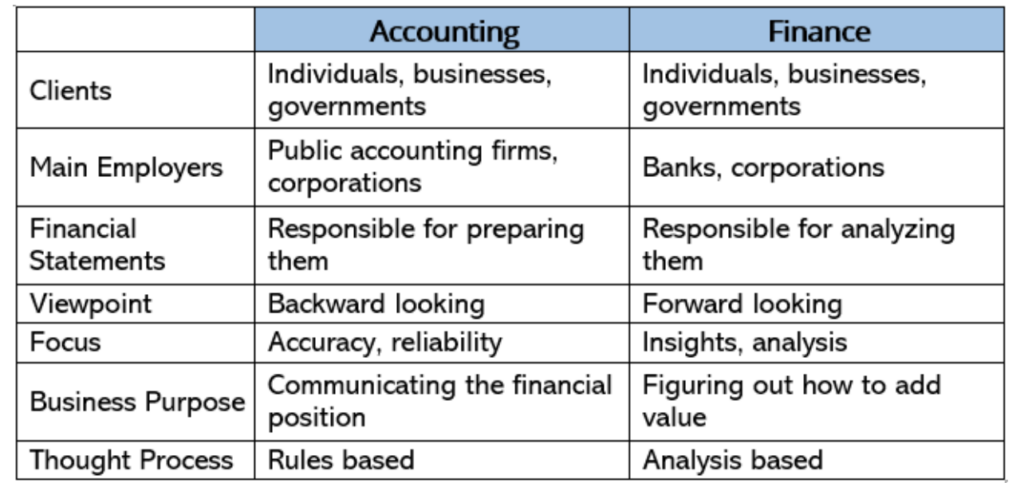

These credentials show a solid understanding of bookkeeping concepts and guidelines. Previous Click This Link experience in bookkeeping, especially in a company setting, is highly valued. Companies search for candidates that have a tested performance history of managing financial declarations, income tax return, audits, and various other bookkeeping jobs. Understanding of accounting software program and tools, such a copyright, Netsuite or Sage, or specialized tax obligation software, is usually needed.

The Buzz on Frost Pllc

Nonetheless, it's important to approach it with the same level of professionalism and reliability and commitment as any other organization endeavor. There's a lot to think of when you start an accounting company. By taking note of the suggestions in this post, you can get your brand-new accountancy firm off to a flying beginning.

As soon as you cover these bases, you'll prepare to start building a name on your own in the bookkeeping globe.

Contact other specialist provider and companies similar to your very own for suggestions on CPAs and/or audit firms - Frost PLLC. Not all auditors have not-for-profit experience, so you must check recommendations and ask for a duplicate of their Peer Review (most states call for auditors to be audited themselves by a 3rd party, which is called a "peer testimonial")

The Frost Pllc PDFs

This is where the not-for-profit can help control a few of the prices of the audit! Study companies that represent the bookkeeping occupation in your state, such as your State Board of Book-keeping, to assist you figure out just how to review the CPA/audit company, based upon criteria that Certified public accountants are anticipated to adhere to in your state.

Request a proposal letter from qualified Certified public accountant companies. Ask for referrals from other tax-exempt, charitable nonprofit clients, informative post and call those recommendations. Do not be satisfied with the first three the audit company gives you.